This weekend, at a wedding between academic philosophers, the kind of event where you find yourself drinking champagne in a hotel room at 2 a.m. and talking about the land economist Homer Hoyt (he's really important!), I found myself explaining why I write about sports when I could be writing about literally anything else that matters more.

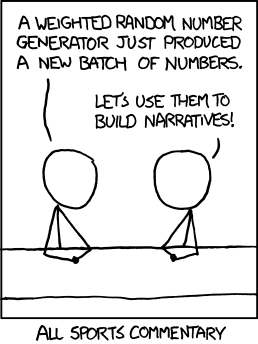

It's not that it's mere entertainment; most popular entertainment intentionally reflects, reframes, and changes the culture it comes from. Sports are a particularly abstracted form of entertainment; here's how the physicist-turned-cartoonist Randall Munroe describes it… and he's not really wrong.

But it matters, even though it shouldn't, or at least it isn't designed to matter.

One of my favorite new data sets that illustrates this is in a recent working paper co-written by the University of Chicago's Thomas Wollmann, an economist who works at its Booth School of Business. It correlates 40 college football teams' performance in the AP poll (a weekly measure of how good the teams are compared to others) over 14 years with their colleges' success in raising research funding (via this great dataviz roundup).

If anything, it's a warning to not completely tank.

Some of the data points in the paper itself is fascinating; a representative of Texas A&M told the authors that, just on the night that Johnny Manziel won the Heisman Trophy, "Texas A&M as a university raised more money than it typically does in a month, setting records for quarterly and annual alumni giving." The University of Texas at Austin—admittedly something of an outlier in its passion for football—has higher revenues than the median pro hockey team. And windfalls return money to the universities' coffers:

For example, in 2012, the Louisiana State University team pledged over $36 million over 5 years to support the school’s academic mission. In 2005, the Notre Dame football used $14.5 million of its postseason bowl winnings to fund academic priorities. From 2011 to 2012, the University of Florida team gave $6 million to cover shortfalls in university funding. From 2012 to 2013, the University of Texas-Austin gave $9.2 million of its $18.9 million football surplus back to the university fund while the University of Nebraska - Lincoln did the same with $2.7 million of its $5.2 million surplus.

But the authors are trying to do more than that with their research. Football revenue is just a means to an end. The second part of their analysis looks at what a large investment in STEM research does to the products of STEM research, i.e. publications and patents. There, they find significant returns:

A one percent change in research support expenditures generates at least about $30,000 in upfront licensing revenues. This equates to 4-5% upfront returns and 9% total returns on investment where total returns factor in average royalty payments. These findings reject the claims of those opposing investments in STEM field university R&D, who argue that even if these expenditures produce “paper” output, i.e. articles and patents, they would not generate genuinely useful innovations.

So the football piece is just part of a two-step argument: a sudden windfall for a university translates into increased research funding. Increased research funding translates into useful (and profitable) research products.