In May of last year, the municipal credit research division of Barclays Capital took a broad look at pension funds across America, focusing on the four most indebted states: California, Massachusetts, New Jersey, and of course us. Their conclusion is sobering, but they're not panicked:

We believe that public pensions are a challenge for state and local governments, but will not cause defaults for the vast majority of issuers. Though the size of the pension shortfall is large, pension liabilities are longer term, and the plans have sufficient assets to pay annual benefits for at least the next 17 years, on average, before including future contributions and investment earnings.

But, like most other analysts, they conclude that we're worse off:

By most measures, Illinois’ pension plans are the most underfunded and at risk of exhausting their assets. Assuming investment returns of 6-8% and absent any actions to increase contributions or reduce benefits, we estimate that the Illinois SURS would be the first Illinois pension plan to go insolvent, in the mid-2020s. Although the state has recently enacted pension reform, that affects only those employees beginning employment in 2011 and beyond. An expected increase in state contributions to the pension funds will continue to put pressure on the budget. We estimate pension contributions and debt service on pension obligation bonds will account for more than 20% of the state’s FY12 general funds’ tax revenues.

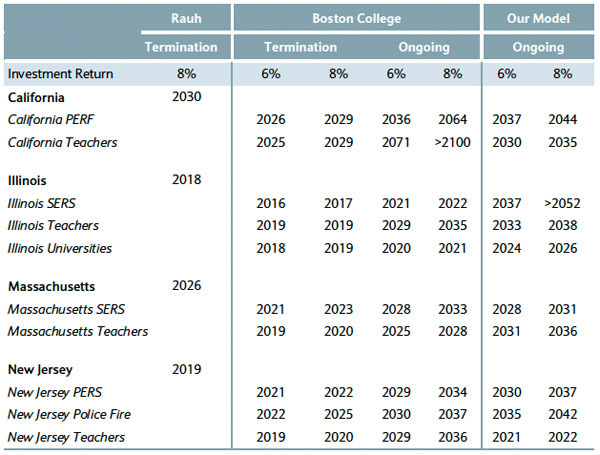

Here's their estimated insolvency dates, paired with those of Boston College's Center for Retirement Research and Joshua Rauh of Northwestern:

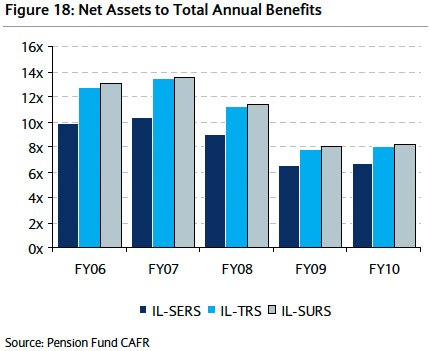

The assets to benefit ratio took a huge plunge in the recession:

You can see how quickly a pension system can go from underfunded but within range of respectability to worrisome:

Confused? This might help:

Funding ratios for Illinois pension plans declined consecutively from FY07 to FY09 as asset valuations fell 31% over the two-year period as a result of poor market performance. In FY10, we saw these valuations bounce back approximately 10%, but funding ratios continued to decline for both SURS and SERS to 40% and 31%, respectively. Declines were primarily due to an increase in liabilities as the discount rate was decreased from 8.5% to 7.75%. The funded ratio for TRS increased from 39% to 41% for FY09 compared to FY10. TRS did not change its discount rate of 8.5%.

This is a small part of why pensions are confusing. First the funding ratio fell because the market declined. Then it fell again because in the wake of the market collapse and everyone losing hope about the future of Wall Street/America/Manifest Destiny, two of the three pensions cut their "discount rate," i.e. the future rate of return. So that's fungible. The bodies are not: "Since FY06, net assets, on average for the combined plans, have fallen 3.1% per year, while annual benefits have grown 6.0% per year. The number of retirees has grown 2.6% per year, and the benefits per employee have increased 3.3% per year."