The Sun-Times has the scoop on a lawsuit filed against Rep. Joe Walsh by his ex-wife over child support. It comes at a pretty critical time for Walsh, as his consistent pounding of the Obama administration on the TV has raised his national profile and his profile within the House. By quite a bit, for a guy who says: "I still am someone who doesn’t understand the way the legislative process works. I do, but I don’t. I can’t find my way around the Capitol."

It’s not the first time that Walsh has faced investigations of his finances—during his campaign, he admitted to having several liens filed against him for unpaid income taxes, and his condo was foreclosed upon, as Dennis Rodkin detailed in November. At the time it looked bad enough that Rich Miller argued that the National Republican Congressional Committee was essentially giving up on his candidacy (in no small part because he was going up against what looked like an inevitable if close loss to Melissa Bean).

Of course, Walsh, who is nothing if not good on the stump, turned his financial problems to his advantage…

“A conflict? Not at all. Here’s the deal with me. You’re seeing a lot of people rise up from the muck we all live in. Especially the last five or six years … When stuff on the foreclosure came out in the spring, many Republicans gave me a stiff arm. The average voter wanted to put their arms around me."

…and, of course, unseated Bean.

Now Walsh’s lawyer is taking a similar tack with the Sun-Times:

“I dispute that he owes the child support that she’s claiming or anywhere near that amount,” Polachek said. “Joe Walsh hasn’t been a big-time wage-earner politician until recently — he’s had no more problems with child support than any other average guy.”

Walsh, for his part, calls the allegations "false" and the article a "hit piece."

I’ve been thinking a lot about Walsh lately, not just because of the odd dynamic of his personal financial problems with the economic crisis and the federal government’s debt, but because of his now-famous YouTube video calling out the President, in which he tells Obama that the government can, indeed, get Social Security checks and the like out the door even if August 2nd passes with no deal.

And I’ve been thinking about that because I’ve seen similar arguments from economists and econ journalists far from Walsh’s place on the ideological spectrum, even if it’s much, much more complicated than Walsh’s wildly reductive spiel. Here’s CNBC’s John Carney in "Can the Treasury Really Run Out of Money"?

When the government writes a check, it goes to whomever is getting paid. The payee then deposits it in its own bank account. The bank then submits it to the Federal Reserve for clearing.

So far, that’s just pretty much the same thing that happens when anyone else writes a check. Except for something very strange—the Obama administration seems to be insisting the Federal Reserve would not allow the U.S. Treasury Department to overdraw its account.

[snip]

But rejecting a check written by the government of the United States would probably violate the dual mandate of the Fed to pursue maximum employment and price stability. A U.S. government that bounced checks would just introduce so much chaos the Fed would likely be obligated by its core mandates to credit the check.

That snippet is basically Carney just asking the question; he lays out scenarios for what might happen if… well, to put it simply, if the government just let the Treasury overdraw and was like, what.

Carney cites Dr. Peter Morici of the University of Maryland:

The Treasury could print money to pay bills and fully finance the government with the potential to drive up consumer prices. Even that could be benign, and if handled properly, be the most sensible strategy if the impasse lasts more than a week or so beyond August 2.

Inflation would make people freak out, but it’s an option.

Felix Salmon responds to Carney:

There’s no reason why this state of affairs couldn’t continue for months. Treasury would continue to spend money, as instructed by Congress in the budget, and Treasury’s overdraft at the Fed would continue to rise. The Fed, for its part, would have two choices when it came to cashing Treasury’s checks: it could either simply print the money, or else it could sell some of its assets — it owns $1.6 trillion in Treasury bonds — and use those proceeds instead. Either way, any bank presenting a check from Treasury could cash it, no problem.

One of his commenters calls this "a terribly pragmatic solution to a dogmatic problem."

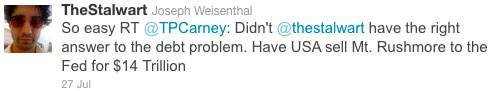

You want more outré ideas? Here’s Joseph Weisenthal of Business Insider:

He pointed to an obscure provision in the 14th Amendment, saying he would unilaterally invoke it “without hesitation” to raise the debt ceiling, “and force the courts to stop me.”

have the Federal Reserve Board destroy the $1.6 trillion in government bonds it now holds.

There’s an element of pie-in-the-sky thinking, or rather pie-at-the-bottom-of-a-very-very-deep-hole. Is any of this a good idea? Not everyone thinks so (Jared Bernstein, Salmon again), but it’s interesting to see people responding to this historical debacle.

What’s going to happen IRL? The odds are, as you might guess, that the Democrats are mostly going to lose. Then there will probably be a "Super Committee." (If inflation really does become a problem, a regular committee would basically just be a breakout session.)