PAID POST BY MASTERWORKS.COM

The world’s richest individuals have been loading up on one distinct asset for years, decades, and even centuries.

Four of the top five members of the Bloomberg Billionaires Index, Bernard Arnault, Jeff Bezos, Bill Gates, and Larry Ellison, collect this asset.

Other famous billionaires, such as Ken Griffin, Marc Andreessen, Chuck Schwab, Oprah Winfrey, and David Geffen, also own this asset.

And it’s no coincidence that the richest families in history, the Rockefellers, Rothschilds, and The Royal Family, have bought this asset for generations, as well.

The uncommon asset that the super-rich have been investing large portions of their wealth in is…

The reality is they’ve been privy to a hidden secret about this alternative asset class.

ART’S ENIGMA REVEALED

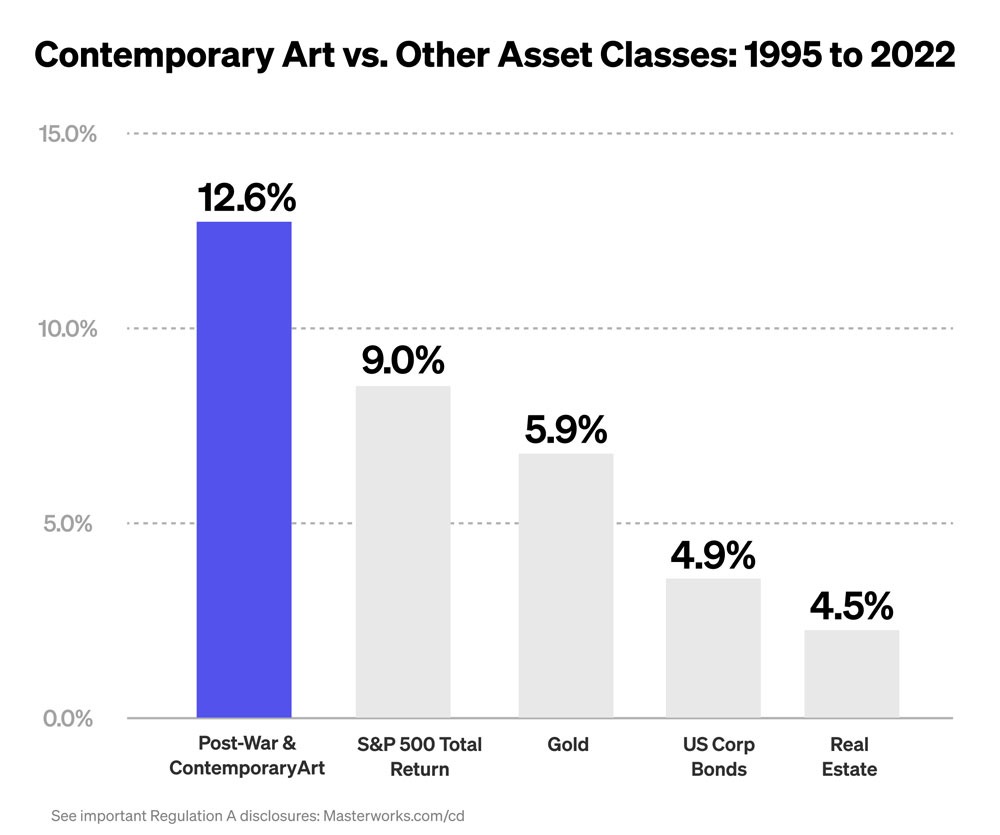

Which is, art prices have significantly outpaced the returns of stocks, bonds, real estate, gold, and other assets – through various market environments (i.e., high-inflationary times, bear markets, bull markets, etc.) – for decades.

Plus, art has ultra-low correlations to other asset classes. Meaning, it tends to zig when other assets zag. And thus, it can help optimize a diversified portfolio.

Now, there has always been one big problem, though.

The upper crust has basically owned this asset all to themselves. That’s because famous paintings are off-limits to regular investors who can’t afford multi-million-dollar price tags.

But now, one innovative company has figured out a way to unlock this asset class for everyone else.

INVESTING IN ART IS NOW EASIER THAN EVER

It’s called Masterworks.

The art investing pioneer, founded by private art investor and tech entrepreneur Scott Lynn in 2017, allows everyday folks to invest in shares of $1-30 million masterpieces from artists, such as Banksy, Basquiat, and Warhol, for a fraction of the typical cost.

The company’s mission is to “democratize contemporary art investing.”

And so far, it’s done an admirable job…

Masterworks has built the “Bloomberg for the art market.” Its one-of-a-kind proprietary database holds over 5 million auction records… with more than 50 million data points… on over 60,000 artists – drawn from archives dating back to the 1960s.

The company has grown to 200-plus employees, including experts from the art industry, and large investment shops, like Bank of America, Goldman Sachs, and Morgan Stanley.

Its team does all the heavy-lifting. Meaning, investors don’t have to worry about research, storage, security, insurance, maintenance, or all the other standard hassles of typical art ownership. It’s all taken care of.

And it has become one of the largest buyers in the art market with nearly $900 million in assets and more than 800,000 members.

However, the best part might be the impressive returns that some platform investors have booked.

ART INVESTMENTS OUTPERFORM WALL STREET’S FLAGSHIP FUND

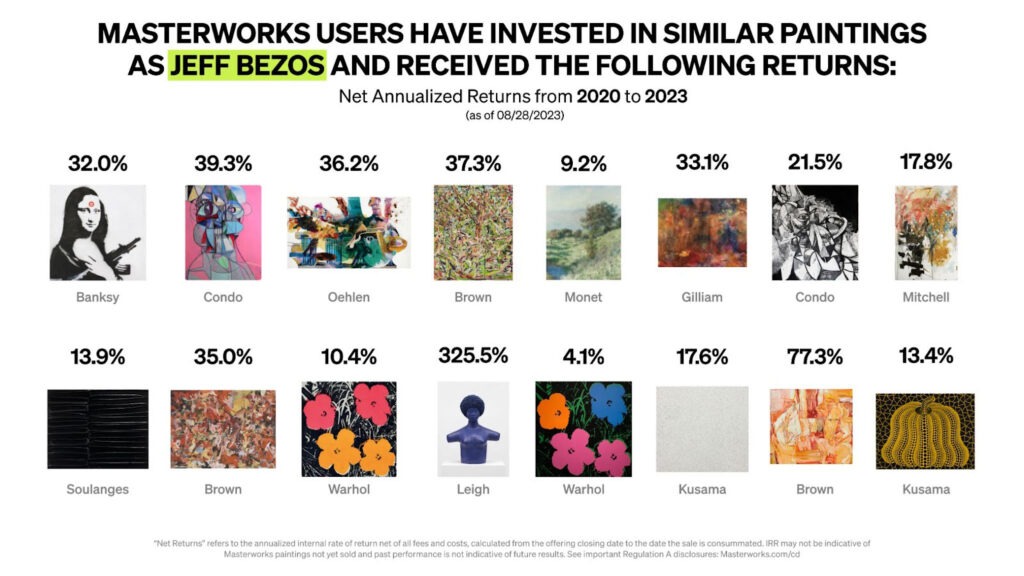

So far, Masterworks has 16 “exits” (sales). All of which have produced positive returns, with investors sharing in excess of $10 million in profits (net of fees).

For additional perspective, 15 of those 16 exits – or 94% – have outpaced the SPDR S&P 500 ETF (SPY) over their holding periods.

Of note, this performance occurred during a period (2020 – 2023) containing 40-year-high inflation, a recession, and the second-worst combined bear market for stocks and bonds in 85 years.

And with results like this, high demand has created a waitlist of prospective members eager to join Masterworks’ platform.

But as a bonus, Chicago Magazine readers can skip the waitlist – and invest like billionaires – with this exclusive link.

Past performance is not indicative of future returns. Investing involves risk. Important Regulation A disclosures and aggregate advisory performance at masterworks.com/cd.

This article has been supplied by Masterworks.com, a paid advertiser. The editorial staff of Chicago magazine had no role in this post’s preparation.